Durable Value is a new strategy process that develops the 6 ‘economic moat’ competitive advantages proven by leading US investors to grow business value:

A dilemma for all companies: pull ahead, and others soon catch up.

Businesses seek to differentiate from their rivals, be unique and to innovate.

Yet any successful move that can be imitated by competitors soon will be due to powerful incentives; to protect their own sales, pursue profitable opportunities and to survive.

The greater the success by one company, the more intense are the efforts by others to duplicate.

The result is short-lived success. For immediately a 2nd and 3rd company offers similar customer value, the differentiation ends and its excess profits fade, as increased competition causes lower margins and fewer sales. A return to a level playing field.

How can a company escape the effects of competition- imitation- dragging on its finances?

And instead break free with materially differentiated customer value that rivals are unable to match. In turn attract customer loyalty, expand market share, increase cash flows and grow company valuation.

The answer is to develop barriers; competitive advantages that block competition.

Barriers enable serving a market with customer value that lacks direct competition, for monopoly-like returns on invested capital. This is the goal of strategy- to minimise competition.

| ‘Barriers to entry’ means rivals cannot do what one or a few companies can, and a competitive advantage is being able to do what rivals cannot.

Therefore the two terms describe the same phenomenon. |

Only six types of Competitive Advantage exist, due to their high barriers.

A group of leading investors studying thousands of successful companies have isolated only six Competitive Advantages that cause business success, because they withstand rival imitation.²

They call these competitive advantages “Economic Moats”- like a moat around a castle- precisely because they act as a barrier protecting the company from rival imitation of their customer value and entry into their market.

Durable Value is a strategy process that develops these six ‘Economic Moat’ Advantages.

Successful companies have advantage barriers lasting from 5 years to 70+. Therefore strategy should focus on developing such enduring barriers.

The Durable Value process creates strategic options for companies that harness these six enduring Competitive Advantages, by:

- Where to compete: Identifying areas in the market where competitive advantages can form,

- How to compete to win: Advising on the actual assets, capabilities and market positions to invest into that would cause a competitive advantage and how to amplify it, and

- How to get it done: Orchestrating the execution of the above and its growth, that gradually dominates market share in a defined area.

To discuss how the Durable Value strategy process can benefit your consultancy:

The common theme shared by all successful companies.

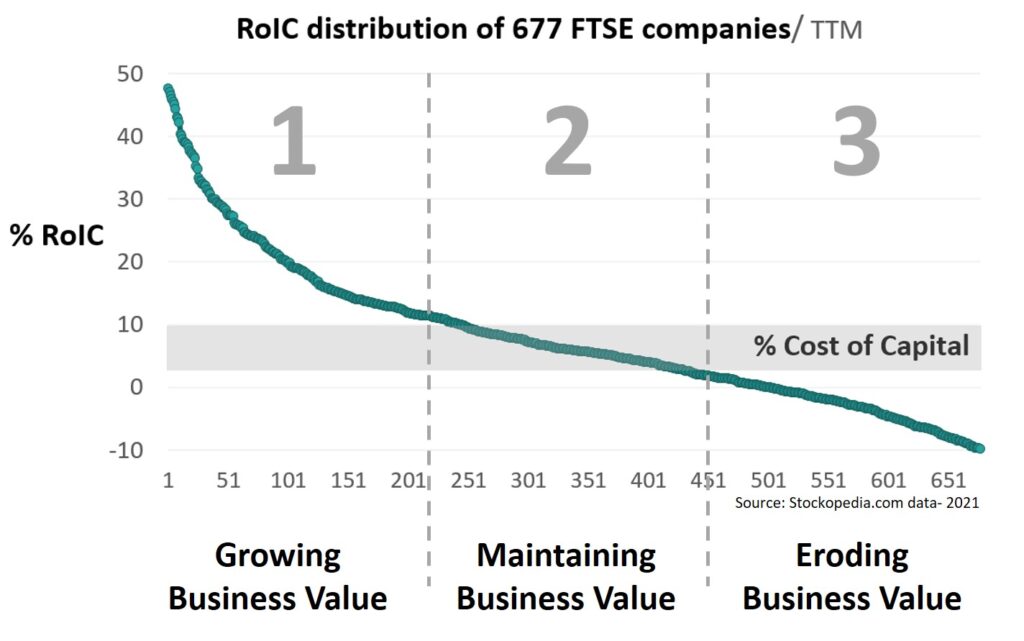

Businesses fall into 3 broad categories:

Group 1- Those that grow business value (by delivering a profit % Return on Invested Capital (RoIC) above the expected return of that capital funding them (‘cost of capital’)¹),

Group 2- Those maintaining business value (their profit returns match the cost of capital), and

Group 3- Firms that erode business value (earn insufficient profit returns).

Attracted by the high returns from the top third of performers, a group of nine US investors² analysed thousands of these successful companies and found two features they all had in common:

1. Barriers to entry preventing rivals from imitating their superior customer value (‘superior’ because no others can copy and match it), and

2. One or more of the 6 types of Competitive Advantages.

(Being able to do what rivals cannot is by definition a competitive advantage. Therefore ‘barriers to entry’ and ‘competitive advantage’ are synonymous with each other).

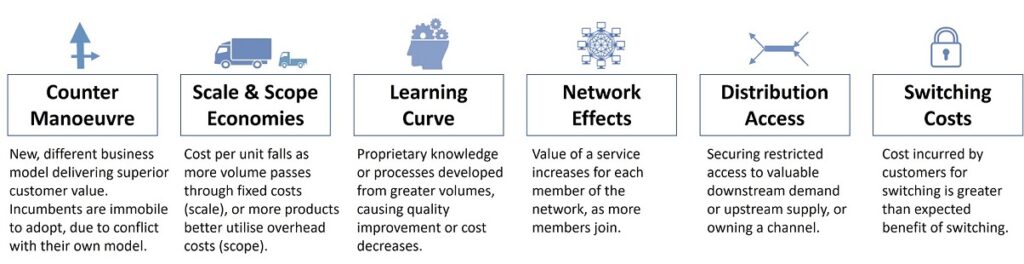

These Competitive Advantages can be defined as:

Furthermore, the competitive advantages apply regardless of whether a business is a light engineering firm that began in the previous century, or a start-up SaaS business. A FTSE 100 or a £1m turnover company.

To see how Durable Value can help your business gain a competitive advantage:

Or get in touch for a 15 minute presentation on how competitive advantages work, or simply to discuss your situation:

Footnotes:

¹ % RoIC defined as: Net operating profit after tax / Total assets – cash and current liabilities.

² These are ‘value’ investors that conduct detailed fundamental analysis on companies: Warren Buffett and Charlie Munger, Paul Johnson, Michael Mauboussin, Bruce Greenwald, Heather Brilliant, Judd Kahn, Elizabeth Collins and Pat Dorsey. Also the VC investor Peter Thiel.