Durable Value identifies start-ups at Seed on track for developing ‘economic moat’ Competitive Advantages in 2-3 years’ time.

How? Through analysing the start-up’s strategy, since strategy is the pre-cursor to competitive advantages developing.

By detecting Competitive Advantage potential at the earliest stage possible- after only 4 months’ revenue- VC investors can secure equity stakes in stronger prospects at lower valuations.

To use Durable Value’s strategy research service as part of your process:

.

Pilot study on 40 pitch decks confirms stability of strategy due diligence framework

Durable Value is a proprietary strategy framework built around creating economic moat competitive advantages. By comparing a Start-up’s strategy to this reference framework, it is possible to identify those on track for developing a competitive advantage in 2-3 years’ time.

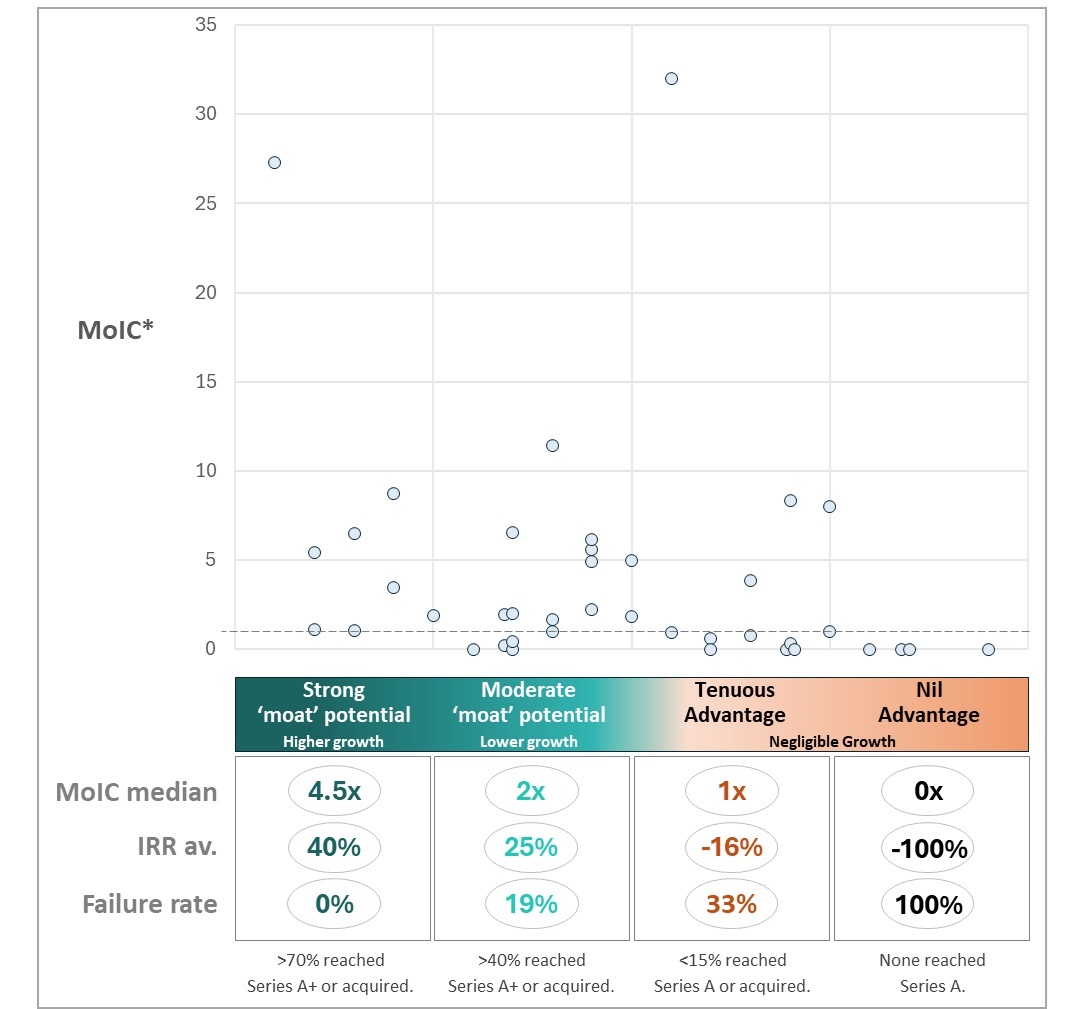

The framework analysed the pitch decks only of 40 US-based Seed start-ups from 2011-2022, scoring each company’s strategy on a spectrum from “strong moat advantage potential” through to “nil moat advantage potential.” The chart below shows the investment outcomes for a Seed stage investor after 4+ years holding period.¹

Start-ups with potential for Competitive Advantages (and growth as a consequence) went on to higher valuations.

80% of start-ups rated as “Tenuous” or “Nil” potential of Competitive Advantage did not return >1x. A serious risk to investor capital.

Past performance is not an indicator of future results.

For information on how Durable Value achieves this:

Why Competitive Advantage potential has an impact on Start-up success

![]() Stronger Product-Market Fit (PMF): To attain strong PMF requires a value proposition that is unique or materially distinctive over alternatives in order to attract fanaticism. Such distinctiveness can only be achieved by either 1. innovation alone, or 2. a competitive advantage defined as ‘doing that which rivals cannot do.’ Since any innovation without an underlying competitive advantage’s defensibility will quickly be imitated, then all strong PMF is either caused by a competitive advantage or requires one to emerge very soon afterwards, to ensure defensibility from imitation.

Stronger Product-Market Fit (PMF): To attain strong PMF requires a value proposition that is unique or materially distinctive over alternatives in order to attract fanaticism. Such distinctiveness can only be achieved by either 1. innovation alone, or 2. a competitive advantage defined as ‘doing that which rivals cannot do.’ Since any innovation without an underlying competitive advantage’s defensibility will quickly be imitated, then all strong PMF is either caused by a competitive advantage or requires one to emerge very soon afterwards, to ensure defensibility from imitation.

![]() Improved Unit Economics: An emerging competitive advantage produces a scarcity of customer value from only one company that confers pricing power for higher gross margins. LTV can also increase (e.g. via Learning curve advantage’s superior value), CAC decline (e.g. through Network Effect connections), as well as reduce churn rate (e.g. via Switching Cost advantage).

Improved Unit Economics: An emerging competitive advantage produces a scarcity of customer value from only one company that confers pricing power for higher gross margins. LTV can also increase (e.g. via Learning curve advantage’s superior value), CAC decline (e.g. through Network Effect connections), as well as reduce churn rate (e.g. via Switching Cost advantage).

![]() Accelerated Growth: Competitive Advantages produce higher customer utility/ usefulness and lowers company cost, over that of rivals. As a start-up grows it widens this ‘utility-cost’ gap, raising customer value and so triggering:

Accelerated Growth: Competitive Advantages produce higher customer utility/ usefulness and lowers company cost, over that of rivals. As a start-up grows it widens this ‘utility-cost’ gap, raising customer value and so triggering:

-

-

-

-

-

-

-

- Expansion of market demand into mainstream adoption, and

- Behavioural growth drivers: word-of-mouth, virality and brand formation (all lowering CAC).

-

-

-

-

-

-

Hence the flywheel reinforcing positive feedback loop that strategists associate with developing a competitive advantage (e.g. network effects attract growth, which feeds back into deepening the network):

![]()

Other benefits for a Seed investor that emerging Competitive Advantages bring include:

Seed to Series A.

- The above three growth drivers lead to an overall faster growth rate compared to other start-ups, thereby attracting finite Series A capital to themselves and away from slower growth companies (a “success to the initially successful” dynamic that contributes to the power law distribution of start-up valuations).

- Reduction of Seed and Series A risks:

-

-

- Product-market fit risk- as noted above,

- Team disbandment risk- founders are incentivised to stay by the increasing commercial promise a competitive advantage brings, and

- Scalability/ execution risk- a competitive advantage offers the manoeuvrability to overcome many scaling challenges.

-

-

Series B, M&A or IPO.

By later stages, competitive advantages are becoming apparent to investors and lead to greater predictability and size of future cash flows via their ability to:

-

-

- carve out further market demand and capture TAM,

- defend against competitor entry,

- accommodate growth capital at high rates of return, and

- endure for multiple years.

-

This culminates in ‘economic moats’ as a driver of future cash flows being of prime importance to later-stage VC investors, acquirers and public markets.

For more information on how Durable Value works:

¹ A copy of the raw data is available on request. Past performance is not an indicator of future results. Note- The average Seed holding period in the sample was only 4.3 yrs before exiting, resulting in a reduced MoIC for the successful companies. The sample’s distribution across the 4 ‘buckets’ is not representative of the overall population of start-ups, as pitch decks that are posted online feature survivorship bias (i.e. failed companies would be less likely to receive coverage), as well as the uploader’s cherry-picking due to their own biases.

*All MoIC calculations are based on a hypothetical entry at a Seed round post-money valuation and exit at a liquidation event. Investor entry was assumed into the next funding round following the pitch deck’s release date. Exit/ Liquidation event was either: M&A, Secondary sale at a later round, Share Buyback after 7 years, or at company Closure. This ignores all pro-rata rights, liquidation preferences etc.