About- Karl Midhage

-

-

-

-

-

-

-

-

-

- 11 years in strategy formulation: Start-ups through to category and corporate-level strategy at Aviva Plc and Yorkshire Building Society.

- Investor in small cap FTSE equities since 2001, analysing strategies of several hundred companies and their outcomes.

- MBA with Distinction (Nottingham University Business School).

-

-

-

-

-

-

-

-

Hi. With a background in business strategy and equity investing, I’ve long been fascinated by ‘economic moat’ competitive advantages and their ability to drive significant company growth.

Finally, here was a concept that could address business strategy’s issues of inconsistent effectiveness in the marketplace and lack of financial accountability.

This led to developing Durable Value- an alternative strategy framework focussed entirely on creating ‘moat’ competitive advantages. 10 years in development, the framework can identify whether a start-up’s strategy will lead to a competitive advantage in the future or not.

E: karl@durablevalue.com

A Timeline of Economic Moats

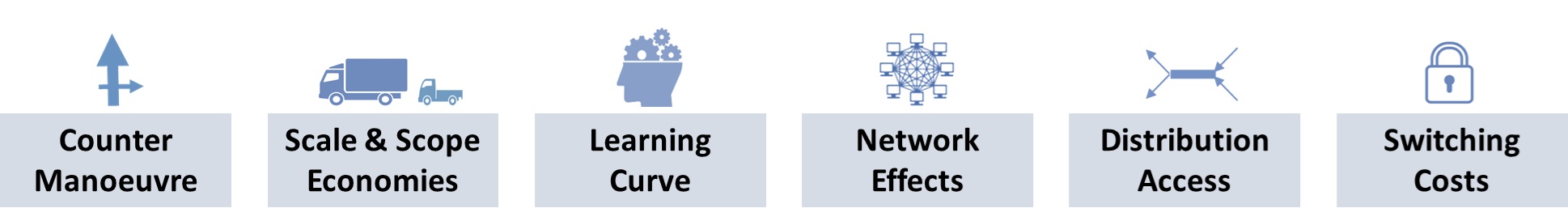

<1980 Certain microeconomic forces are repeatedly found to drive excess profits and cascade market share to one or a few companies: scale economies (1770s), distribution/ access rights (1870s), learning curves (1960s) and switching costs (1980s).

1980 Strategy guru Michael Porter lists the ‘barriers to entry’ protecting companies from rivals in his 5 Forces model (e.g. scale economies, capital requirements, switching costs, access to distribution channels, learning curve, proprietary technology, access to raw materials or locations, and government policy (e.g. licences)).

1986 Warren Buffett first mentions ‘economic moat’ in a Berkshire shareholders’ letter:

“The difference between GEICO’s costs and those of its competitors is a kind of moat that protects a valuable and much-sought-after business castle.”

1996 Network Effect is considered an economic moat and is used to justify internet stock valuations as the dot.com bubble takes hold.

1997 Credit Suisse First Boston’s Michael Mauboussin and Paul Johnson (with Alfred Rappaport) connect Buffett’s economic moats to the formation of competitive advantage periods (CAP), in a pioneering series of articles that synthesise moats and strategy into equity research. They create CAPatColumbia.com, tying CAPs and strategic behaviour to equity valuations.

2000 Strategy leader Gary Hamel lists the economic moats as ‘profit boosters’ in a model of strategy formulation in his book “Leading the Revolution.”

2005 Bruce Greenwald publishes “Competition Demystified”, distilling strategy to the protection of economic moats and the alternative options for companies lacking a moat.

2008 Morningstar launch a ‘wide moat/ narrow moat/ nil moat’ classification to their equity research services, headed by Pat Dorsey. Later, Heather Brilliant & Elizabeth Collins publish “Why Moats Matter” applying economic moat analysis to companies across all sectors.

2013 Investment funds increasingly state the assessment of economic moats as part of their company selection criteria.

2014 (DurableValue.com goes online (whois.com), exploring moats from a business perspective of the coordinated strategic actions and market conditions necessary to create a moat advantage).

2016 VC Peter Thiel outlines in “Zero to One” the economic moats that could lead a start-up to having a monopoly, and the importance of dominating a small market, before expanding.

Investor and strategist Hamilton Helmer adds ‘counter-positioning’ to the moat collection, in his book “7 Powers.” Applies a moat strategy framework at his fund strategycapital.com

VC Brian Laung Aoaeh overlays Morningstar’s moats to start-ups, seeking companies with ‘moat potential.’

2021 Fund manager Mike Tian and VC Rick Zullo introduce ‘moat trajectory’- companies with growing moats or start-ups on path to attaining such an advantage.

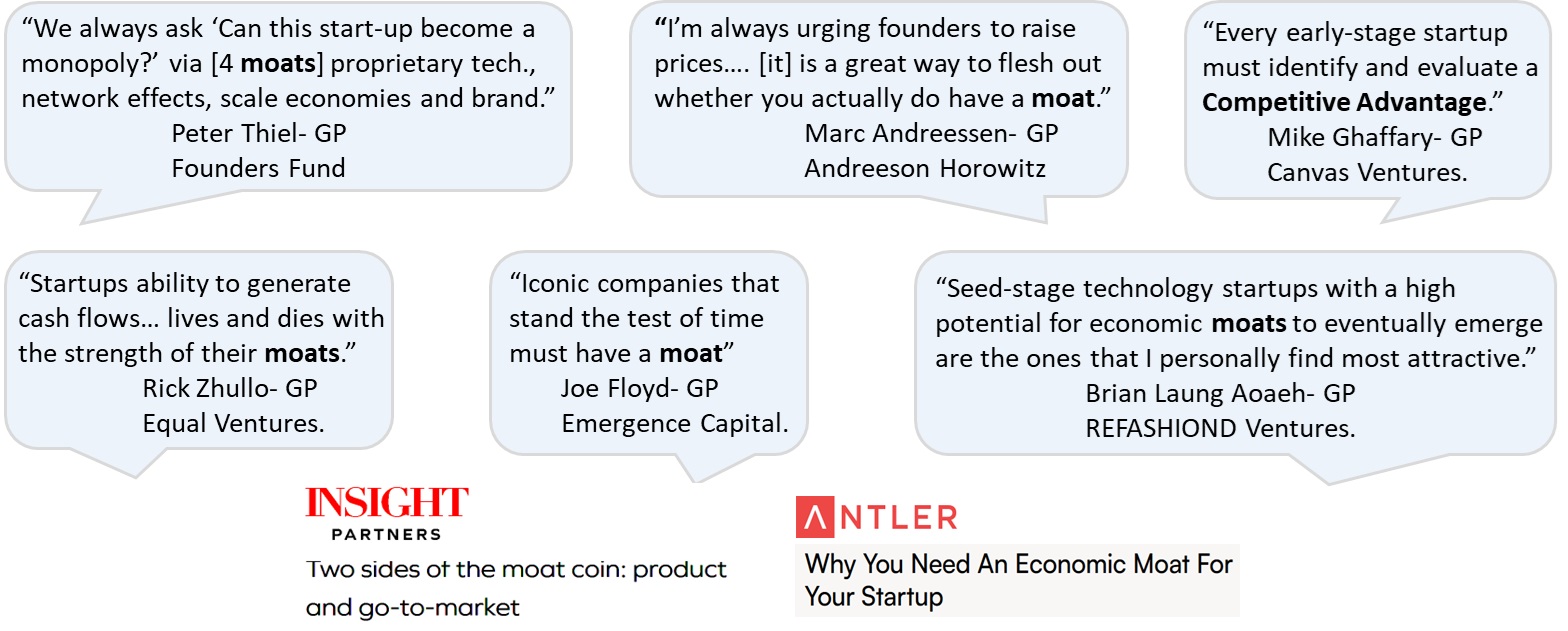

2024 Now it is becoming standard practice for VC private equity to assess a company’s economic moat, as it has for over a decade in public equity markets: