A narrow specialism with an outsized impact

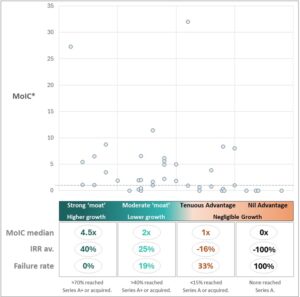

Seed investing is challenging, with over 45% of VC-backed early stage start-ups failing to return investor’s capital¹, placing a reliance on 1-2 companies in a portfolio to return >30x.

To minimise this failure rate, investors typically assess a start-up’s situational factors on the left. And to compensate for the losses, seek huge potential returns from the right:

However this investment process leads to the power law-distributed outcome of many failures and a few outliers. An investor can be highly skilful and yet their portfolio struggle, if 1 or 2 outliers don’t emerge.

Durable Value is different. It is entirely agnostic to the qualities of each criterion, instead solely assessing whether they overall constitute a strategy that could lead to a competitive advantage in 2-3 years’ time:

A Start-up needs a competitive advantage if it is to capitalise on the market opportunity in 3+ years, without which it will very likely fail.

Following this comprehensive appraisal, the strategy due diligence service then gives each Start-up a rating:

It is an unusual approach that can supplement the investor’s own process and expertise without overlap, bringing richness to the information-light Seed stage and a source of analytical advantage.

To use Durable Value’s strategy due diligence service as part of your process:

To visit the pilot study:

Strategy & ‘moat’ Advantages at Seed stage

For Start-ups, their strategy is to create customers and scale up, leaving ‘moat’ Advantages to chance.

Business strategy is “a plan of action to develop a Competitive Advantage and compound it”², with competitive advantages defined as delivering superior customer usefulness and/ or lower cost to a company over its rivals, and such rivals cannot reach parity for 3+ years.

However for Start-ups, the aim is to first attain strong product-market fit (PMF) and therefore their ‘strategy’ (as product, business model etc.) represents their best estimate as to where the PMF lies. After attaining PMF, their strategy’s aim is to then scale as quickly as possible. At no point in this early stage does creation of a competitive advantage take centre stage.

Instead, competitive advantages are considered secondary and their emergence is largely serendipitous, because founders are at the mercy of their innovation, its PMF and scaling as to whether this configuration will by chance align with competitive advantage creation or not. Solving customers problems does not endow a company with a competitive advantage.

“Successful companies do not create moats. They happen naturally or by accident.”

Andy Rachleff- co-Founder of Benchmark Capital and Wealthfront.³

“Will this Start-up be able to survive and thrive?”

That depends on whether a competitive advantage will emerge, for its absence will mean no defensibility from imitation if a company’s innovation was to briefly take off. Instead, many Start-ups as business experiments or value hypotheses become the equivalent of free R&D, subsidised by its founders and investors, for nimbler Start-ups and more powerful incumbents to emulate.

This should not be surprising, for in an age of low Start-up technical risk and high market risk, once market demand is proven, the technical side is often straightforward for others to reproduce. Furthermore, as investor Michael Mauboussin points out “companies generating high economic returns will attract competitors willing to take a lesser, albeit still attractive return, which will drive aggregate industry returns to opportunity cost of capital.”⁵ Indeed the greater the success by one company and the larger the perceived TAM opportunity, the more intense will be the competition (e.g. generative AI).

It is this haze of competition that drives the need for defensibility through a ‘moat’ competitive advantage.

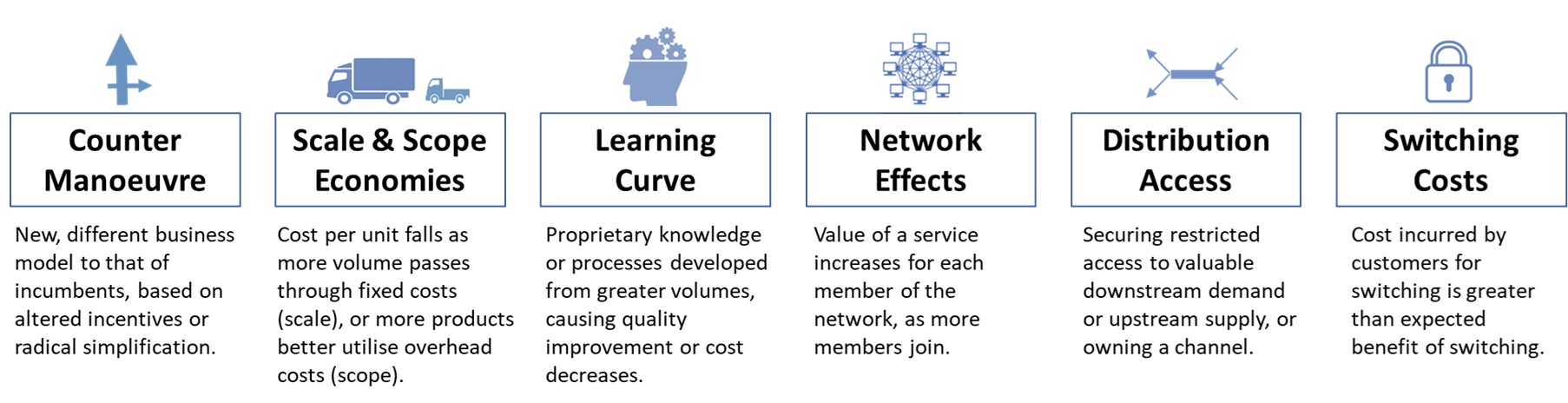

Six types of Competitive Advantage have emerged due to their high barriers to rival entry.

Below are examples of how these 6 moat advantages relate to Start-ups, based on the analysis of many Seed pitch decks and subsequent company outcomes:

Counter-Manoeuvre. This is critical for Start-ups entering an established market to compete directly with powerful incumbents. If larger incumbents typically respond to successful Start-ups 4-7 years after their inception⁶, then a Counter-Manoeuvre advantage can delay this response further, giving a Start-up precious time to create a defensible beachhead. Examples of this advantage in Seed pitch decks have included:

-

-

- a different pricing model based on usage (incumbents are locked into an alternative pricing method and associated incentives, metrics, structure, client-base etc.), or

- a tech-enabled bespoke service versus incumbents batched services (competitors cost focus locks them into batching only).

-

Scale and Scope Economies. A common belief is that scale economies are unattainable for Start-ups, as they lack market share gain over competitors. Yet from pitch decks analysed, scale economies can emerge in places such as:

-

-

- A geographic radius that a start-up is able to dominate (and scale up by dominating multiple areas), or

- Markets with high fixed costs relative to market size, to result in an unreachable minimum efficient scale needed to be cost viable.

-

However, large and sprawling markets hinder scale economies as rivals can gain the volume necessary to be cost competitive. Also software’s high fixed cost: variable cost ratio is insufficient on its own to attain a scale economy advantage- additional fixed cost investment is needed as to push the minimum efficient scale beyond the reach of rivals.

Learning Curve. To capitalise on this a Start-up needs to be on a materially different learning trajectory to that of incumbents. However if the market grows too rapidly as to enable other Start-ups to reach learning curve parity via their own growth in sales, or incumbents to justify heavy investment, then this competitive advantage can be minor. Successful learning curves identified at Seed stage have included:

-

-

- Combining offline with online tech for the first time,

- A proprietary technology previously developed by a founder, or

- Multiple technologies coordinated together for the first time.

-

Network Effects. Many pitch decks by platform companies show exponential user adoption over several months, only for the company to close two years later, such is the nature of platform economics. The challenge is to distinguish the few that can reach network effect’s critical mass in the future, from the many riding on early adopter novelty. The former can be identified by analysis of:

-

-

- Hub formation, node connections and the incentives from both buyer and seller sides,

- How the core attractor variable will change with scaling,

- Repeat usage potential (before engagement metrics are known), and

- Probability of various network failures (e.g. the ‘cold start’ problem is still unsolved, asymptotic behaviour, knife-edge balancing of supply and demand, trust issues, disintermediation risk, multi-tenanting risk, network polluters).

-

Network effects can fail to materialise in many ways.

Distribution Access. Has the Start-up any pinch points, bottlenecks, first-mover pre-emption or other strategic high grounds of influence that they are on track to securing, for bargaining power over others? Some examples identified in Seed pitch decks include:

-

-

- a new channel or interface,

- early access to APIs,

- contracts, and

- highly specialised founders.

-

Switching Cost. At Seed stage with negligible customer retention or churn data available, switching costs can be determined by viewing the start-up’s value proposition from the perspective of the user. Examples of switching costs emerging include:

-

-

- client onboarding onto the proposition as a preliminary integration cost,

- selling add-ons, or

- the product tightly integrating over time with the client, or with the client’s client.

-

To use Durable Value’s strategy due diligence service as part of your process:

¹ Based on the % of an early stage (Seed and series A) VC portfolio delivering a realized 0-1x MoIC, with data points from:-

– 24% self-declared as delivering <1 MoIC. Source: “Practices of EU VCs”- April 2023 at https://www.calameo.com/read/00013720638802630c2f1 Page 50. Data from 530 early-stage VCs.

– “45% of investments failed to return 100% of capital”- based on a sample of 20 early-stage investment funds between 2006 and 2011 investing in over 500 companies. Source: https://www.industryventures.com/insight/winning-by-losing-in-early-stage-investing/

– 50% of deals done by LP Horsley Bridge between 1985- 2014 generated <1x return, based on backing Seed and early-stage venture investors. Source: https://www.linkedin.com/posts/rubendominguezibar_the-vc-power-law-curve-horsley-bridge-an-activity-7146552435149377536-IfzF https://www.horsleybridge.com/about

– 53% of Angel investments are exited at <1x, from a sample of 1,200 exits by US and England Angels from 1998- 2012: https://techcrunch.com/2012/10/13/angel-investors-make-2-5x-returns-overall/

– 65% of both early and later-stage investments had a gross realized return of 0-1x. Source: Correlation Ventures VC, based on % of financings from 2004-2013, n = 21,640 financings. https://metiquity.ca/about/research/demystifying-venture-capital-investing/

² As defined by Bruce Henderson- founder of Boston Consulting Group.

³ See: https://innovationfootprints.com/opposingviewpoints-economic-moats-happen-accident/

⁴ Source: https://a16z.com/where-to-go-after-product-market-fit-an-interview-with-marc-andreessen/

⁵ Michael Mauboussin – Measuring the Moat http://csinvesting.org/wp-content/uploads/2013/07/Measuring_the_Moat_July2013.pdf

⁶ Source: https://blog.eladgil.com/p/defensibility-and-competition