Services

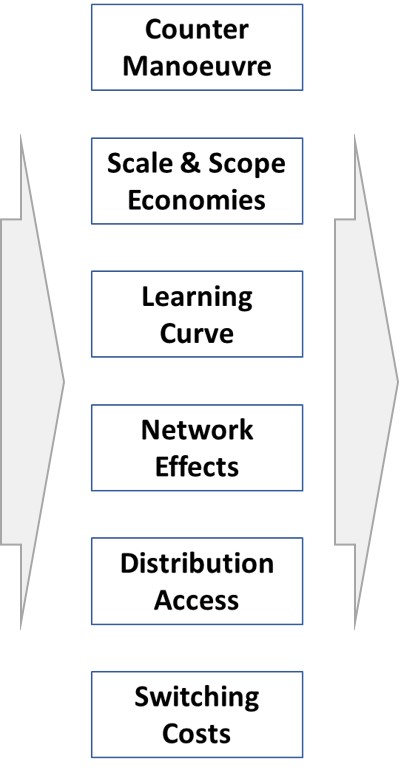

Durable Value offers two services, each harnessing the 6 Competitive Advantages recognised for growing the value of companies:

• For companies without a clear advantage over rivals, Formulation service helps create a strategy that leads to an enduring competitive advantage,

• For firms already with an advantage, Expansion service advises on growth paths that deepen the advantage, for a stronger overall business.

Which service best addresses our challenges and goals?

Formulation service can help companies:

- Experiencing a squeeze on sales and margins from increased competition, or

- With the ambition for a high growth rate (revenue >15%+ p.a.) over a 5 year time-frame,

- That wish to remain the same size for control purposes, except be more profitable, or

- With an ebbing strength in today’s changing market that needs reinvigorating.

Expansion service can benefit companies that:

- Have grown in the past, but sales have since levelled off, or

- Are reliant on one or a few key clients, and seek to de-risk revenue,

- Over-extended into unrelated areas previously, and are now wanting to rationalise into a more focussed business (the service can advise which areas to close, and potential competitive advantages to invest the proceeds into), or

- Have growth plans already in place, and seek an independent 3rd party perspective, prior to committing resource.

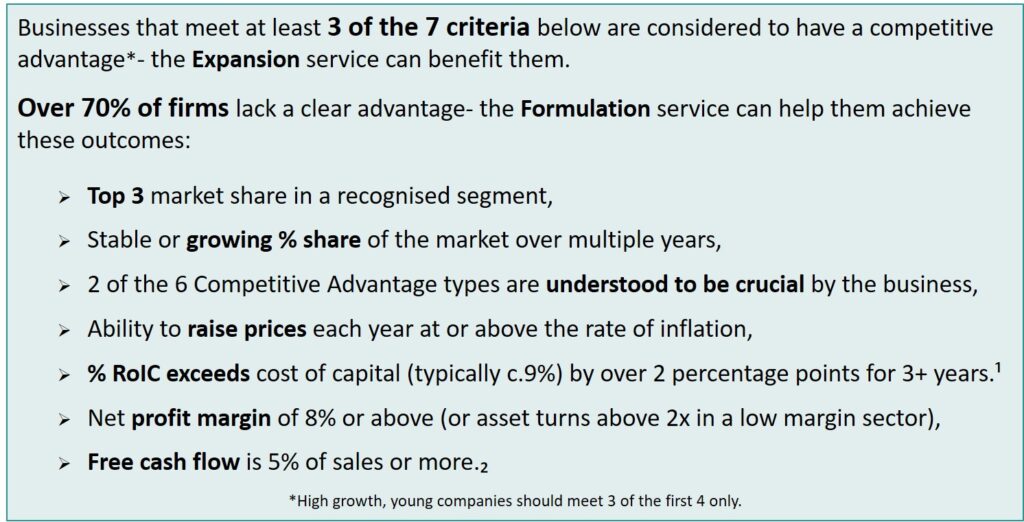

Has our company a competitive advantage?

.

Formulation- A strategic start

Identifies strategic options for a client to develop a competitive advantage, and builds the most appealing into a compelling strategy.

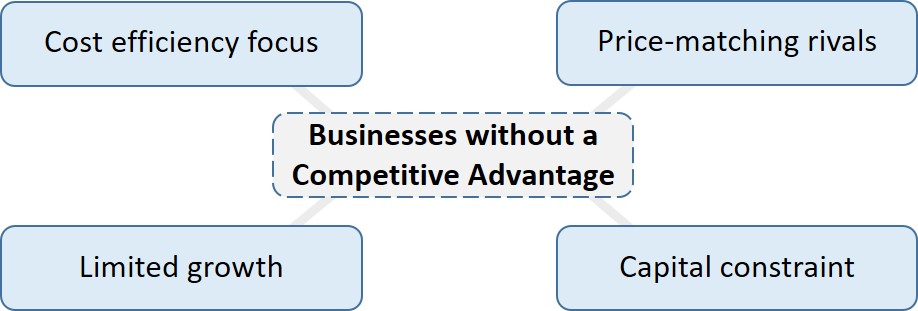

A majority of companies lack a distinct competitive advantage, or have a declining advantage past its best years. Instead, they face a familiar situation:

How can an ambitious company turn this situation around?

Durable Value’s process helps clients to develop a competitive advantage (CA), based upon the 6 types of advantage. Formulation service achieves this by identifying areas of the market as strategic options where there is strong potential for the client to develop a competitive advantage.

From these options, the most attractive to the client is developed into a strategy, with a clear understanding of:

-

- The defined target sector,

- A plan of investment into assets, capabilities or market positions that are unique to, or far greater than, those of rivals,

- How the above will lead to superior customer value proposition(s) over alternatives, and

- Execution of the strategy, by amplifying the key parts and compressing time taken to implement.

Execution is key. Rather than leaving a client with a static ‘strategic plan’, the goal of this service is to maximise the likelihood that a client can successfully develop a competitive advantage.

“The obvious questions are: what is my strategy’s probability of success, and what actions can we take to improve that probability?”

Sven Smit- Senior Partner- McKinsey consultancy.₂

Great execution improves the chances of success, achieved by embedding competitive advantages within the company and converting into superior customer value over rival alternatives.

For a 15 minute presentation on how competitive advantages work and the Durable Value process, or simply to discuss your situation, get in touch.

Strategy is fundamentally about delivering customer value in a way that rivals cannot match, for sustained business growth.

.

Expansion- Optimised growth

Advises on growth plans that best utilise a client’s underlying competitive advantage and strengthens it, for successful new growth and a stronger overall business.

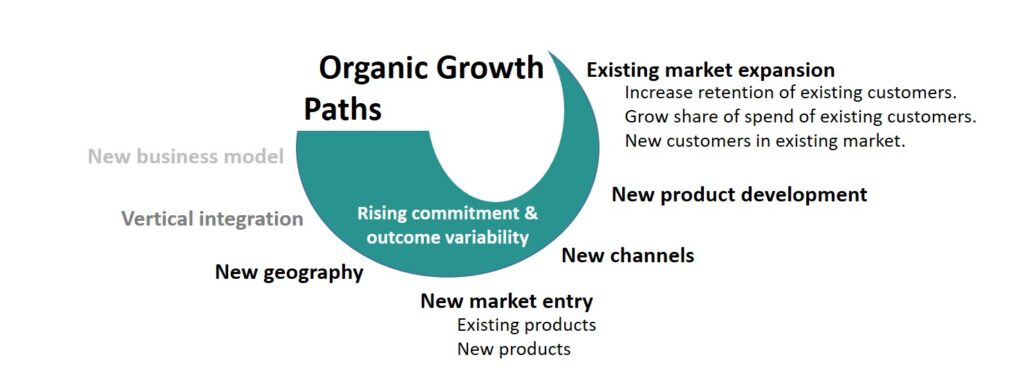

With many growth paths open to a company with an existing competitive advantage (CA), deciding on the ideal route can be unclear:

However all growth adds complexity to the business and therefore extra cost. Furthermore, growth requires additional capital¹. Therefore growth can only increase a company’s value if it earns a profit return on that capital (RoIC) in excess of the cost of capital funding it.₂

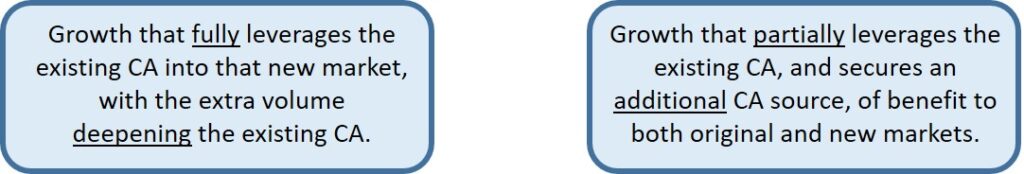

To achieve sales growth that can offset this additional cost and earn a sufficient profit return, there are two routes:

Durable Value can advise on growth paths that best fulfil either route.

Expansion service does this by first applying knowledge of the 6 competitive advantage types to gain a detailed insight into the client’s advantage in their existing markets.

“The best adjacency moves grow out of a minute understanding of the core business.”

Chris Zook- Partner at Bain consultancy and author on growth strategies.₄

Next, this understanding of the competitive advantages (CA) is used to generate growth paths- or assess the client’s growth plans- that best:

- Leverages the existing CA in the new market, and

- Strengthens the CA, either by deepening the existing CA with more volume, or adding new CA sources to it.

Growth paths that meet this stringent criteria will not only enable the client to deliver a compelling customer value proposition in the new market that rivals cannot match, but will also strengthen their core business too.

Finally, a checklist of traditional analysis is applied to a shortlisted growth path, to highlight risks and hurdles: demand stability, sector trends, market structure (competitor power etc.), own brand recognition, own capability gap to serving the market, customer proposition testing etc.

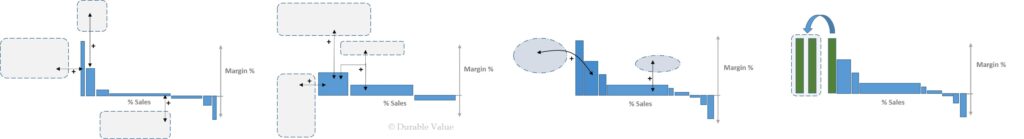

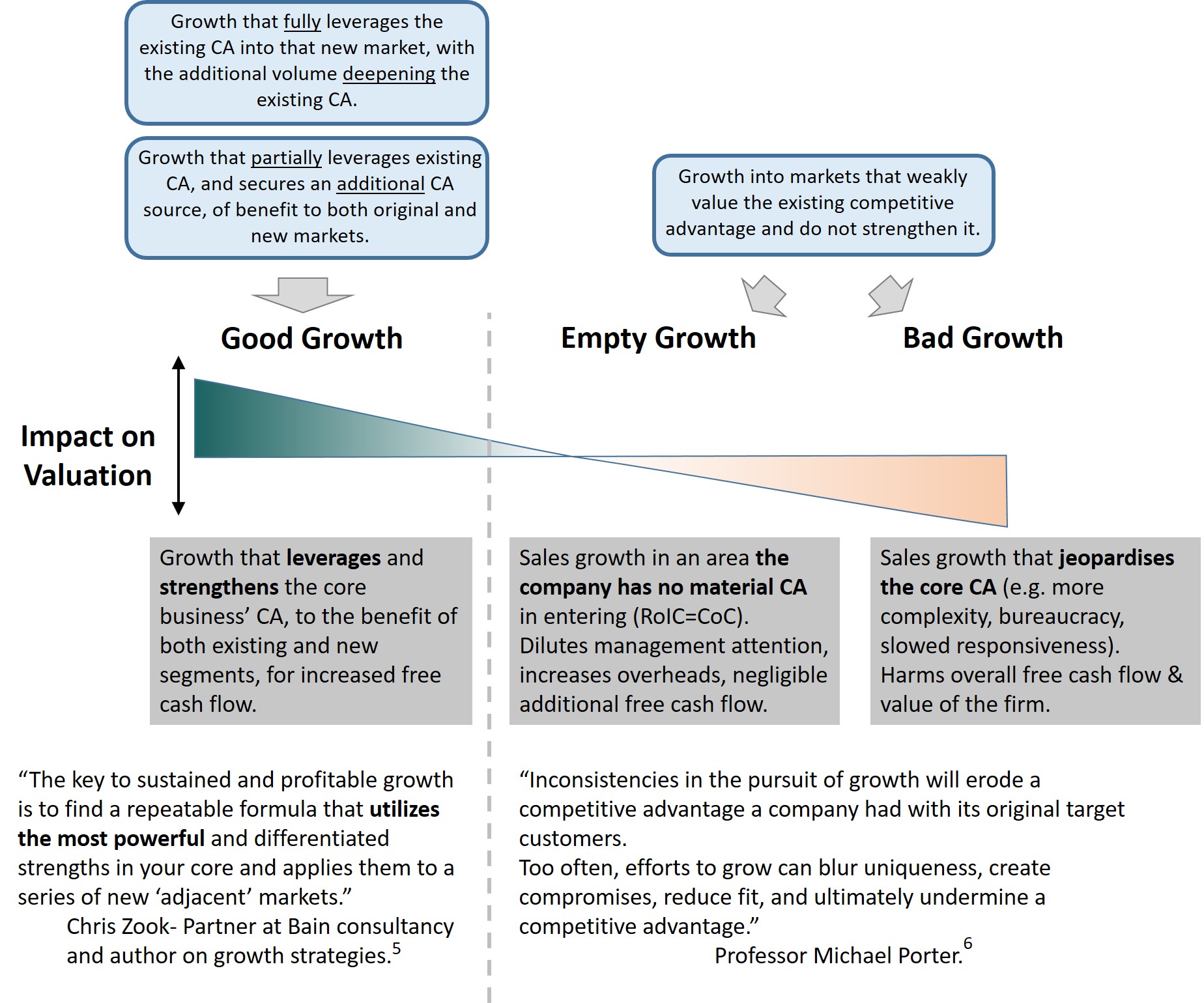

The most important, yet often overlooked, criteria in deciding growth is how it will impact the core business’ competitive advantage.

This is a counter-intuitive approach that primarily considers the impact of growth on the overall company, when typically the focus is solely on the new market in isolation, which often leads to ’empty growth’ with nil change in business value (or worse, a deterioration in value).

Instead, ‘Expansion’ service helps to navigate clients towards good growth outcomes:

Growth can have a considerable impact on business value, positively or negatively.

For a 15 minute presentation on competitive advantages and how Durable Value can guide profitable growth, or simply to discuss your situation, please get in touch:

Footnotes:

Overview:

¹ RoIC as: net operating profit after tax / Total assets – cash and current liabilities.

² Free cash flow as: net operating profit after tax + depreciation – capex –/+ change in working capital.

Formulation:

¹ https://www.youtube.com/watch?v=tyUw0h5i9yI&t at 39mins 37sec.

₂ https://www.linkedin.com/pulse/why-strategy-like-poker-golf-sven-smit/

Expansion:

¹ It can be easy to assume that sales growth comes with no cost attached; the sales’ profit will finance the cost surely?

However as a firm’s sales increase, it must be supported by more working capital current assets and long-term non-current assets created in virtual lock step with that sales growth:

- More receivable

- More inventory

- More plant, property and equipment (unless operating below MES and therefore sub-optimally with under-utilised assets).

- Usually, more advertising investment into the brand to increase sales, that should then be capitalised as ‘economic goodwill’ (or else deducted from operating profit).

The above amounts to growth Capex. Only a small portion of these assets is ‘funded’ or offset by increased liabilities with zero interest from: an increase in accounts payable (delay to pay suppliers) due to more purchases for growth, wages (pay to staff) and tax (to government). All are credits extended to the company, for which no interest is paid.

Therefore: (Increase in assets to meet Sales growth – non-interest liabilities)* cost of capital funding the growth

= True cost of assets needed to support sales growth.

To deliver the sales growth, this growth in assets has to be funded by extra invested capital from either: a. retained earnings, b. more debt or c. sale of additional shares, all of which have a cost of capital that the sales growth has to generate a sufficient profit to meet.

Said differently, all 3 reduce the cash distributable and so can produce zero additional free cash flow and zero change in the value of the firm to equity holders, if RoIC=Cost of capital. Hence with growth there is “no such thing as a free lunch.”

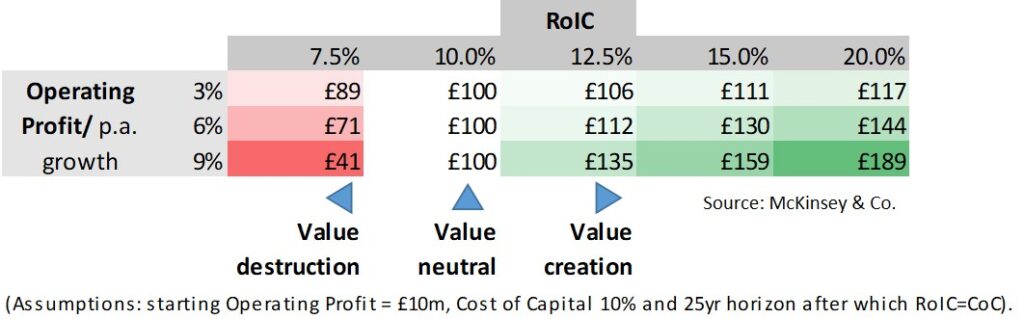

₂ Growth only increases company value if its profit return on that capital (RoIC) is in excess of the cost of capital funding it. Using the Economic Value Added approach, sales growth as additional business value =

Invested Capital necessary to fund that sales growth (due to the above footnote) x (RoIC – CoC).

E.g. £10m x (7% -7%) = £10m x 0% = Zero value added.

Only growth at a similar high % RoIC can increase a company’s valuation, as shown in green:

How a £100m Company Valuation is driven by RoIC and Growth.

Source: Adapted from- McKinsey & Co., Tom Copeland, Tim Koller & Jack Murrin- ‘Valuation: Measuring and managing the value of companies.’

₃ “Investing in [growth] projects that do not earn the costs of capital may drive [sales and] earnings per share growth, but will clearly destroy shareholder value. This type of investing goes on every day in corporations around the world” Michael Mauboussin – Thoughts on Valuation. 1997. https://www.kellogg.northwestern.edu/faculty/korajczy/htm/mauboussin.valuation.pdf

₄ Increasing the odds of successful growth: the critical prelude to moving “beyond the core.” Chris Zook.

₅ “What is strategy?”- Michael Porter. http://www.rcmewhu.com/upload/file/20150528/20150528184258_9036.pdf

₆ Chris Zook- “Profit from the Core: A Return to Growth in Turbulent Times.”